Last month, the US Securities and Exchange Commission (SEC) passed a rule that will require resource extraction issuers to disclose the payments that they make to governments for the commercial development of oil, gas and minerals resources. This is a significant step forward also for Indonesia as several companies listed in the US operate in the country and the data of the payments that these companies make to the Indonesian government will now become available. Similar laws already exist in the EU, Canada and Norway. The number of oil, gas and mining companies in the US is huge and, on top of that, they are classified as big extractive companies as they operate around the globe with significant capital.

The meaning of project-level reporting In Indonesia

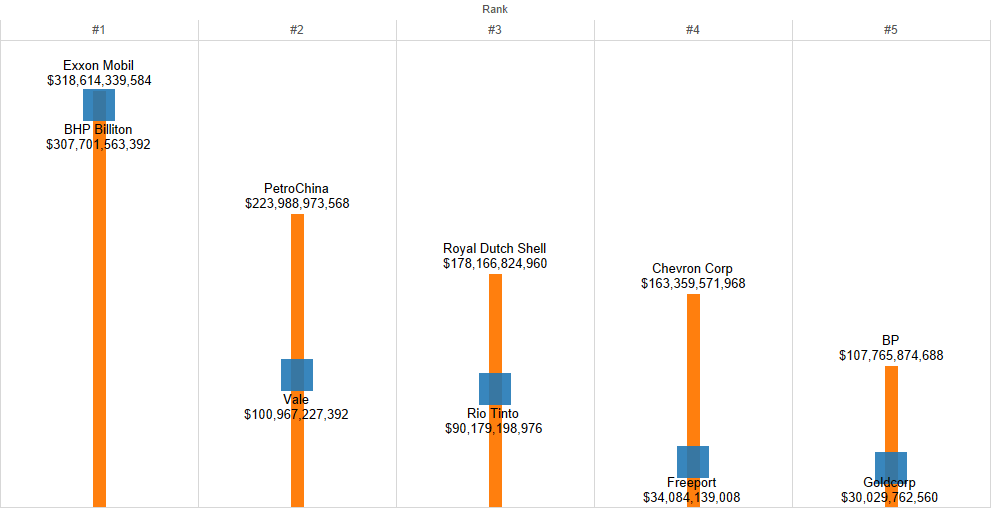

According to official website of Energy and Mineral Resources Ministry, US oil and gas companies operating in Indonesia include Exxon Mobil, Chevron, and ConocoPhillips. Mining companies that operate in Indonesia are Freeport McMoran and Newmont. Other prominent extractive companies operating in Indonesia include BHP Billiton, Tullow, Statoil and Kosmos. These have all committed to conducting their business activities in a transparent manner. Statoil is subject to Norwegian Law under which, in addition to needing to report the amount of payments that they make, companies also have to provide information about the investment value of their company, its subsidiaries, the number of employees, production volumes, purchases of goods and services, and inter-company interest expenses.

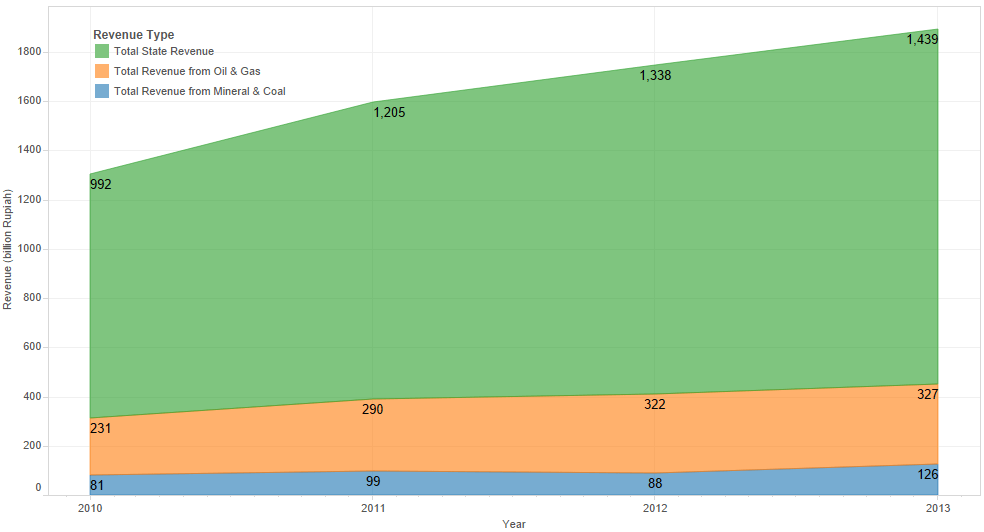

Extractive companies’ payment to Indonesia government (Source: 2015 mandatory disclosure payment to government)

Last month, the US Securities and Exchange Commission (SEC) passed a rule that will require resource extraction issuers to disclose the payments that they make to governments for the commercial development of oil, gas and minerals resources. This is a significant step forward also for Indonesia as several companies listed in the US operate in the country and the data of the payments that these companies make to the Indonesian government will now become available. Similar laws already exist in the EU, Canada and Norway. The number of oil, gas and mining companies in the US is huge and, on top of that, they are classified as big extractive companies as they operate around the globe with significant capital.

The meaning of project-level reporting In Indonesia

According to official website of Energy and Mineral Resources Ministry, US oil and gas companies operating in Indonesia include Exxon Mobil, Chevron, and ConocoPhillips. Mining companies that operate in Indonesia are Freeport McMoran and Newmont. Other prominent extractive companies operating in Indonesia include BHP Billiton, Tullow, Statoil and Kosmos. These have all committed to conducting their business activities in a transparent manner. Statoil is subject to Norwegian Law under which, in addition to needing to report the amount of payments that they make, companies also have to provide information about the investment value of their company, its subsidiaries, the number of employees, production volumes, purchases of goods and services, and inter-company interest expenses.

Extractive companies’ payment to Indonesia government (Source: 2015 mandatory disclosure payment to government)

The total state revenues in 2015 from the extractive industries in Indonesia reached $7.7 billion, with around $6.25 billion from oil and gas and $1.45 billion from mining. About 7.62 % of Indonesia’s gross domestic product came directly from the extractive industries in 2015.

Project level reporting is needed so that people know how much revenue is received by the government and so that they can actively participate in monitoring extractive industries happening in their area. Moreover, in Indonesia, the disaggregated data is useful for local government as it allows them to verify the total of government revenues earmarked to be transferred and the allocation of revenue sharing funds. Finally, for businesses, this data on payment is useful in risk analysis and decision-making.

Project level reporting can be one of the most powerful tools to prevent mismanagement of revenues at the local level. Improving extractive industries governance can only happen with public participation. The public has a right to know how much taxes has been paid by companies, how much royalty, bonuses, and other revenues that have been paid by companies and if a company contributed enough to national wealth and the protection of the environment. The environmental impact caused by extractives industries may actually be greater than the amounts that the government received. These questions can be addressed more through further analysis if, among other things, project level data is published and can be easily accessed by the public. For transparency, information disclosure is meaningful and empowering.

Payment disclosures started when Indonesia implemented EITI. Through the EITI, companies that operate in Indonesia are required to report any other material payments to government above an agreed threshold on project level. Some of the payment data included in the EITI report are corporate and dividend taxes, signature and production bonus, over/under lifting, royalties, land rents, and dividends. This data needs to be reconciled with the amounts received by the government to verify whether the values report are correct or not. This is done with someone assigned to review and reconcile these amounts, and report any discrepancies. If there are different discrepancies, it could mean that there are loopholes in the revenue of extractive industry governance in Indonesia, which could lead to corruption or other abuses. The government is expected to act upon these discrepancies.

The absence of comprehensive information leads to poor assessments and gives more rooms for illicit financial activities such as corruption and embezzlement (Olcer, 2009).

The actor(s) behind such illicit revenues also can be identified. As such, project-level reporting can be highly beneficial for addressing corruption, considering the EI sector itself is considered the world’s most corrupt industrial sector (OECD, 2014).

Payment disclosure has a positive impact on EI companies’ financial performance, including price ratios, returns on equity, and invested capital (Toledano and Topal, 2012).

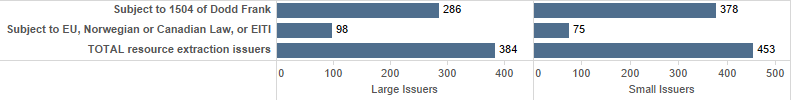

What is subject to project-level reporting

According to Publish What You Pay US, at least 837 companies listed in the US Securities and Exchange Commission (SEC) would be subject to Section 1504 of the Dodd Frank rule. Based on their market cap, of these 837 companies, 453 companies are small issuers, with a market cap less than $75 million and 384 companies are large issuers as they have a market cap over $75 million. The threshold for the payment that must be disclosed is equal to or exceeds $100.000 for the same fiscal year, whether a single payment or a series of related payments. The types of payments included are taxes, royalties, fees, production entitlements, bonuses, dividends, payments for infrastructure improvements, and CSR payments. All of these must be made at the project level.

According to the diagram above, of these 453 small issuers, 75 companies are subject to EU, Norwegian or Canadian mandatory disclosures laws, -and to voluntary disclosures through the EITI. And of the 384 large issuers, 98 companies are subject to EU, Norwegian or Canadian Law. From the 837 companies, 570 had substantial payments (reported annual revenue of $100.000 or greater) and 267 didn’t.

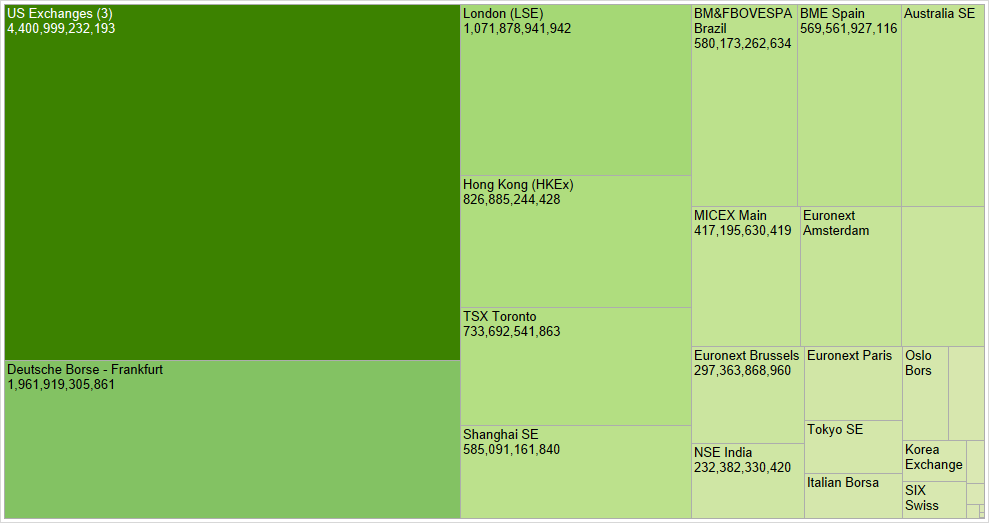

The diagram above shows that the US Exchanges ranks first with a market value of $4.4 trillion, followed by the Frankfurt Stock Exchange with a value of $1.9 trillion and the London Stock Exchange at $1 trillion. With such a high-value capital from those companies in the US, transparency of the payment amount is considerably significant and worth to be applied shortly

What’s next?

For PWYP Indonesia, this transparent project level reporting will be used as an additional instrument to cross-check the production of mining, oil and gas exploration in resource rich district and help local government to check that fair revenue is transferred by central government so that it would minimise the potential of corruption.