Community empowerment to understand the importance of transparency and accountability in revenue management, particularly in the natural resources sector, is one of the focuses on the Mining Sector Social Accountability program. The activity was supported by FITRA, a strategic partner of Publish What You Pay (PWYP) Indonesia. FITRA is a Civil Society Organization (CSO) that consistently promotes transparency and accountability on state financing so that the budget can be optimized for the public interest.

On the program framework, FITRA provides analytical support and knowledge sharing to program partners and field facilitators in the three pilot project areas on budget and revenue management from the mining sector. On June 8, 2021, FITRA shared the results of their analysis on the revenue posture, particularly the contribution of the mining sector, in the participating areas on the program, Aceh, East Kalimantan, Southeast Sulawesi, as well as at the district level of the community assisted areas around the mining site, including Nagan Raya District (Aceh), Kutai Kartanegara Regency (East Kalimantan), and North Konawe Regency (Southeast Sulawesi).

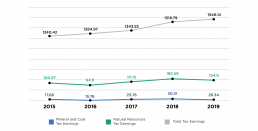

FITRA shared the results of their analysis related to managing mineral and coal revenues and their posture in the program-assisted areas. Gulvino, the FITRA researcher, began the presentation with the statistics on tax contributions from the mineral and coal sub-sector (minerba). In 2019, the amount was Rp 26.34 trillion, while the natural resources revenues were Rp 154.9 trillion.

Graph of Tax Contribution from Natural Resources and Mining Sector (data is processed by Fitra)

On deeper analysis, there are several exciting findings related to the mineral and coal tax contributed from the land and building tax (PBB), corporate tax, and VAT:

- Earning tax from mining sector amounting to Rp8.07 trillion

- Mining revenue is the most significant contributor to non-oil and gas natural resources revenue

- Mining revenue increased by an average of 5.3% in the 2016-2020 period

- Revenue from mining tax is still relatively minimal

“It will be interesting to compare the revenue with the minings’ PBB contribution with the permits issued. There are dynamics of revenue and permit expansion,” said Gulvino.

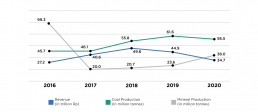

Graph of Mining Revenue and Production (Modi Accessed on June 5, 2021)

Gulvino added that the revenue and production data are also comparable. “From our analysis, the increase in mineral and coal revenue is not linear with coal production and mineral production, especially in 2018 to 2020. The increase in coal production and mineral production should be aligned with the increase in tax revenues from these two sub-sectors”.

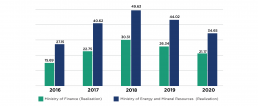

Graph of Differences in Non-Tax State Revenue Data between the Ministry of Finance and the Ministry of Energy and Mineral Resources in Trilion Rupiah. Source: Data is processed from Central Government Financial Report (LKPP) & Minerba One Data Indonesia (Modi) (2016-2020) and accessed in 2021

Not only that, FITRA also found a significant difference in non-tax state revenue (PNBP) data between the Ministry of Finance and the Ministry of Energy and Mineral Resources. The reason behind such discrepancy needs to be confirmed to relevant stakeholders; data issue will be one of topics discussed in the multi-stakeholder forum which is positioned as one of the main strategies in the social Accountability program in mining sector.

On the one hand, the government continues to strive to improve the data discrepancy issues, regulations, and the use of ICT tools known as the e-PNBP application of the Directorate General of Mineral and Coal. This application is a web-based online application used to calculate, verify, and pay the required fees of mining permit holders for Minerba non-tax revenues (PNBP), including the fixed fees, royalties, and sales of mining products (PHT). The e-PNBP application is also integrated with the Online PNBP Information System (SIMPONI).

FITRA further reviews mineral and coal revenue management by referring to the results of the Supreme Audit Agency’s (BPK) audit in 2019. On the one hand, there was a potential of unpaid fine receivables by the government (Rp 2.5 billion and USD 899,210.29), while on the other hand, there was an error of acceptable imposition to the companies amounting to Rp7 billion and USD 717,459.06. Another finding indicated the potential for unpaid PNBP of Rp 4 billion and USD146.751.00 even though the verification value of the final PNBP has been issued. On the last part, it turns out that the Directorate General of Mineral and Coal at the Ministry of Energy and Mineral Resources has a potential debt for overpayment and PKP2B set off at least Rp602,144,586,994.47.

BPK also audits the governance of the e-PNBP application. From the BPK audit, there were 9,389 transactions pending verification, and 133 transactions were rejected from the total of 15,575 transactions. The verification process is critical with the concern if the verification and e-PNBP admins do not yet have the same perception on dealing with the issues on PNBP management, calculation, and the use of the application.

Rizkia, another FITRA researcher, continued sharing the findings on the budgeting, particularly in Nagan Raya Regency, Kutai Kartanegara Regency, and North Konawe Regency. It is essential to understand that the management of mining revenues that the central government oversees will impact local government budgets, as there are several types of revenues transferred to local governments (provincial and district/city).

In the Regional Revenue and Expenditure Budget (APBD), the distribution of income from the mineral and coal sector is found in the Regional Original Revenue (PAD) and the Balancing Fund. In particular, the scheme of transfer to the regions and village funds (TKDD), the actual contribution of the mineral and coal sector, and other natural resources can be traced through the Revenue Sharing Fund (DBH).

From the results of a study of the APBD and TKDD postures in the three assisted districts, it was found that Nagan Raya Regency has a relatively small average share of DBH (in the 2019-2021 period) in the TKDD scheme, which was only 2.1%. The average mineral and coal DBH allocation in the same period were only Rp. 2.75 billion.

Meanwhile, the share of DBH in North Konawe Regency (in TKDD) reached 11.7%, with average mineral and coal DBH allocation was 83.96% of the total DBH received by North Konawe.

The high dependence on natural resources DBH is also found in the Kutai Kartanegara Regency, where the average DBH reaches 72.45% in the allocation of TKDD. The average mineral and coal DBH reached Rp 1 trillion.

“The government has indeed provided the information on the revenues, including from the mining sector. It opened the space for the public to think critically and had the data cross. The public can exercise their right to question the revenue policies in the mining sector, including its use, if it provides optimal benefits for the community, especially the affected people,” said Rizkia.

In closing, Maryati Abdullah, as Program Director of the Social Accountability in the Mining Sector, reiterated the importance of mining revenue analysis as the initial baseline to determine the direction of mining social accountability piloting development at the sub-national level. The exchange of knowledge and synergy between partners is vital in carrying out future programs, especially in monitoring through scorecards. Through knowledge sharing, it is expected that there will be symmetrical information and knowledge regarding aspects of the mining sector’s revenue and its management.

Reference:

Laporan Keuangan Pemerintah Pusat (LKPP) Audited. (2020), page110 (https://www.kemenkeu.go.id/media/18103/lkpp-2020.pdf)

Laporan Keuangan Pemerintah Pusat (LKPP) Audited. (2019), page 90 (https://www.kemenkeu.go.id/media/15858/lkpp-2019.pdf)

Laporan Keuangan Pemerintah Pusat (LKPP) Audited. (2018), page 81 (https://www.kemenkeu.go.id/media/12590/lkpp-2018.pdf)

Laporan Keuangan Pemerintah Pusat (LKPP) Audited. (2017), page 228 (https://www.kemenkeu.go.id/media/10117/lkpp-2017.pdf)

Laporan Keuangan Pemerintah Pusat (LKPP) Audited. (2016), page 185 (https://www.kemenkeu.go.id/media/10236/lkpp-2016.pdf)

Minerba One Data Indonesia (MODI) KESDM. https://modi.esdm.go.id/penerimaan-negara