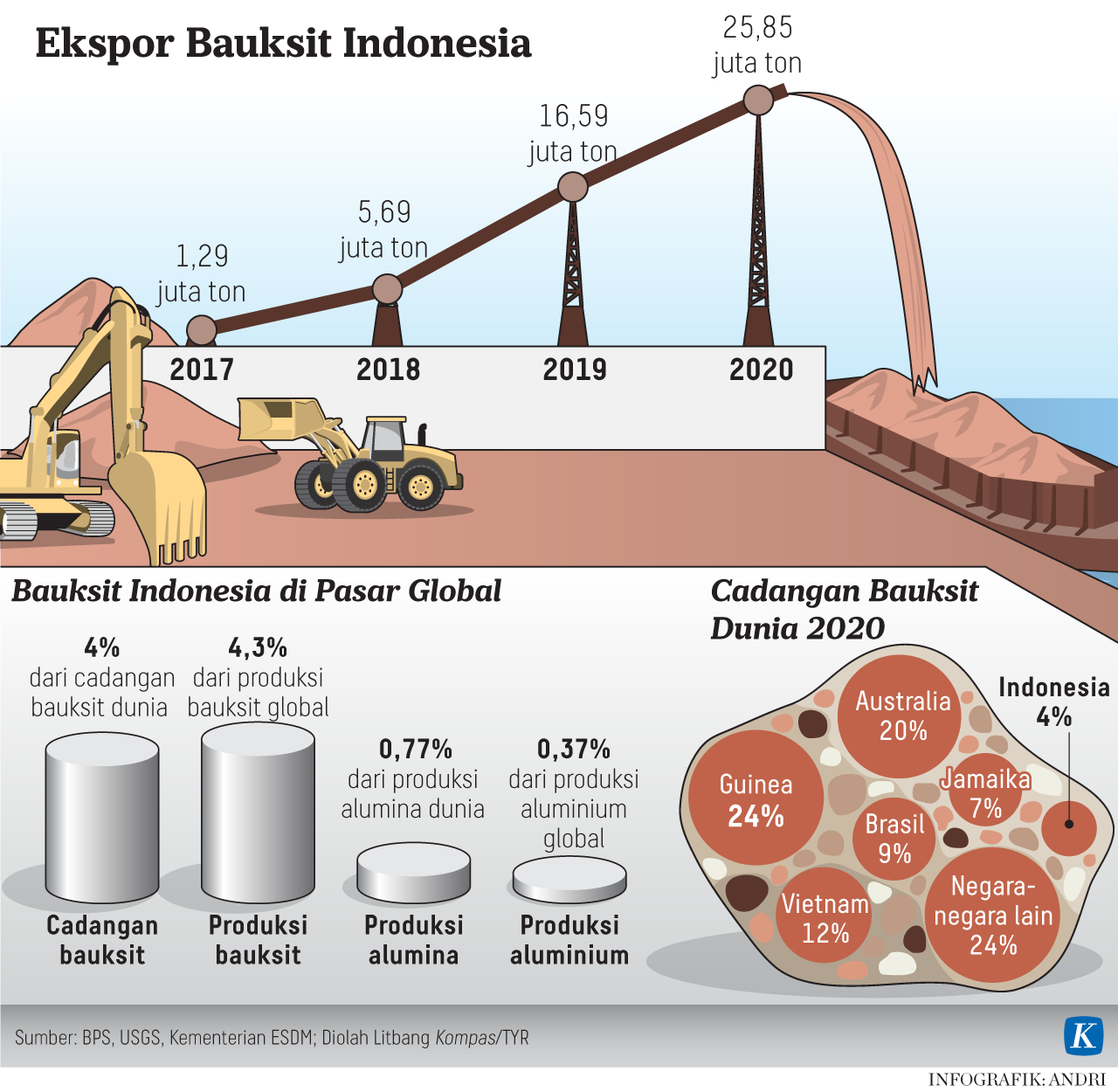

JAKARTA, KOMPAS – The Indonesian government decided to stop the export of raw bauxite starting June 2023. The decision, among others, was based on the cessation of nickel ore exports, which increased the export value of nickel-derived commodities.

The cessation of nickel ore exports since 2020 increased the export value of nickel-derived commodities from only USD 1.1 billion or IDR 17 trillion at the end of 2014 to USD 20.9 billion or IDR 326 trillion in 2021. President Joko Widodo estimated that by 2022 nickel exports could exceed IDR 468 trillion or more than USD 30 billion. This success will be followed by eliminating raw material exports from other commodities.

“Starting June 2023, the government will impose a ban on the export of bauxite ore and encourage the domestic bauxite processing and refining industry,” President Joko Widodo said at the Merdeka Palace, Jakarta, Wednesday (21/12).

Merdeka Palace, Jakarta, Wednesday (21/12/2022). On that occasion, the President was accompanied by the Coordinating Minister for Economic Affairs, Airlangga Hartarto, and the Minister of Energy and Mineral Resources, Arifin Tasrif.

At the beginning of the bauxite ore export suspension, President Jokowi admitted it would cause the export value to decline. However, when stopping nickel ore exports, the jump in export value will begin to be felt in the second, third, fourth, and so on. The industrialization of bauxite in the country is estimated to increase state revenue from Rp 21 trillion to around Rp 62 trillion. “So, I told the minister, do not hesitate, do not be indecisive about this policy, we must be sure,” said the President.

Airlangga added that the suspension of bauxite ore exports covers all types of raw bauxite, including washed ore. All bauxite ore must be processed in Indonesia starting June 2023. This arrangement will encourage savings in aluminum imports. Currently, Indonesia still imports $2 billion worth of aluminum per year. After downstreaming, foreign exchange savings from aluminum imports can be made.

Airlangga added that the suspension of bauxite ore exports covers all types of raw bauxite, including washed ore. All bauxite ore must be processed in Indonesia starting June 2023. This arrangement will encourage savings in aluminum imports. Currently, Indonesia still imports $2 billion worth of aluminum per year. After downstreaming, foreign exchange savings from aluminum imports can be made.

Currently, said Airlangga, there are four bauxite refining facilities (smelters) in the country with a capacity of 4.3 million tons. In addition, there is still the construction of bauxite smelters with an input capacity of 27.41 million tons, while the production capacity is 4.98 million tons or close to 5 million tons.

Meanwhile, Indonesia’s bauxite reserves are still 3.2 billion tons. The reserves are believed to be sufficient for bauxite smelters in Indonesia. In fact, according to Airlangga, the reserves can still be used for 12 other smelters.

Bauxite derivative products prepared domestically include alumina, aluminum, and refining aluminum ingots which can then become aluminum bars or plates. In addition, aluminum bars and receptacles can be used by other industries that now have ecosystems in Indonesia, namely the machinery and construction industries.

Roadmap needed

Regarding the policy to ban bauxite ore export starting in 2023, the Chairman of the Indonesian Chamber of Commerce and Industry (Kadin), Arsjad Rasjid, said that industry players support the ban. According to him, the government’s policy is correct because it has the spirit of encouraging industrial downstream so that it can create added value for the Indonesian economy as a whole.

“The spirit is positive, wanting to build something for Indonesia,” said Arsjad.

However, Arsjad admitted some bauxite industry players will be affected and are not ready for the policy. Kadin will help find a middle ground on this issue. “If not, we will never be ready,” he said.

Meanwhile, according to the Chairman of the Energy and Mineral Resources Division of the Indonesian Employers Association (Apindo), Sammy Hamzah, domestic bauxite downstream should be treated like nickel. The nickel industry worked upstream to downstream to give birth to electric vehicle batteries. The electric car industry is also being worked on.

Regarding the downstream of bauxite in the country, the National Coordinator of Publish What You Pay (PWYP) Indonesia, Aryanto Nugroho, in a webinar on Wednesday, said there must be clarity on what kind of industry is to be developed from bauxite.

“The bauxite industry must be clear, what is to be built? Is it only at the half (finished) level? Then, along the bauxite value chain, ESG (environment, social, and governance) must also be applied, including standards related to the environment,” said Aryanto.

He also cautioned against the building of as many smelters as possible due to the high demand for nickel and bauxite while the downstream industry is still being prepared. If the downstream is not ready, the results of bauxite processing in the smelter will be exported and then imported as finished goods.

According to the Chairman of the Indonesian Mining Experts Association (Perhapi), Rizal Kasli, most bauxite smelters in 2023 are still in construction. Currently, only two bauxite smelters are in operation, while 12 others are still under construction.

When the smelter construction is completed, Rizal said, domestic absorption of bauxite ore increases. However, if smelter construction is completed later, bauxite absorption will continue. He encouraged the government to remap the capacity of smelters that will operate so that the policy to stop exporting bauxite ore is optimal.

“If the production is far above the absorption capacity of the smelter, there will be a halt in bauxite mining operations which will lead to layoffs and other double impacts, especially in the regions,” said Rizal.

Apindo General Secretary Eddy Hussy added that exports of raw commodities, such as nickel ore, are needed in global economic uncertainty. Export proceeds strengthen the trade balance surplus and maintain the economy of the community and bauxite-producing regions. “Therefore, the government is better off implementing other policies, such as increasing bauxite export taxes,” he said.

Source: Kompas