The recent EU-Indonesia trade agreement may bring more EU investments to the island nation, but it lacks the enforcement mechanisms necessary to guarantee the environmental and worker benefits outlined in the deal, according to industry experts.

Indonesia and the European Commission finalized negotiations on a Comprehensive Economic Partnership Agreement (CEPA) on Sept. 23, after more than nine years of negotiations. The deal is expected to take effect in January 2027.

The agreement includes what the European Commission called a “strong sustainability pillar” to ensure that increased trade between the EU and Indonesia values the environment and workers’ rights. However, the pact is not strong enough to fix the environmental, social, and governance issues plaguing the sector, experts told Platts, part of S&P Global Commodity Insights.

“This is a trade agreement, not an environmental [one],” said Rachmi Hertanti, a researcher at the Transnational Institute, a think tank in the Netherlands.

‘Weak’ ESG enforcement

CEPA will remove Indonesia’s 98.5% tariffs on EU goods and provide a more attractive regulatory environment for EU investors in Indonesia, according to the European Commission.

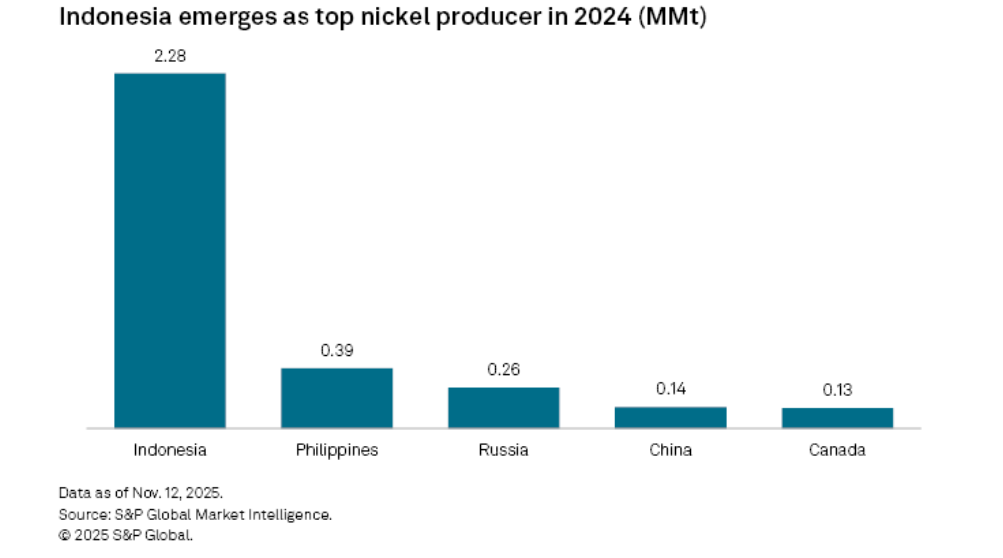

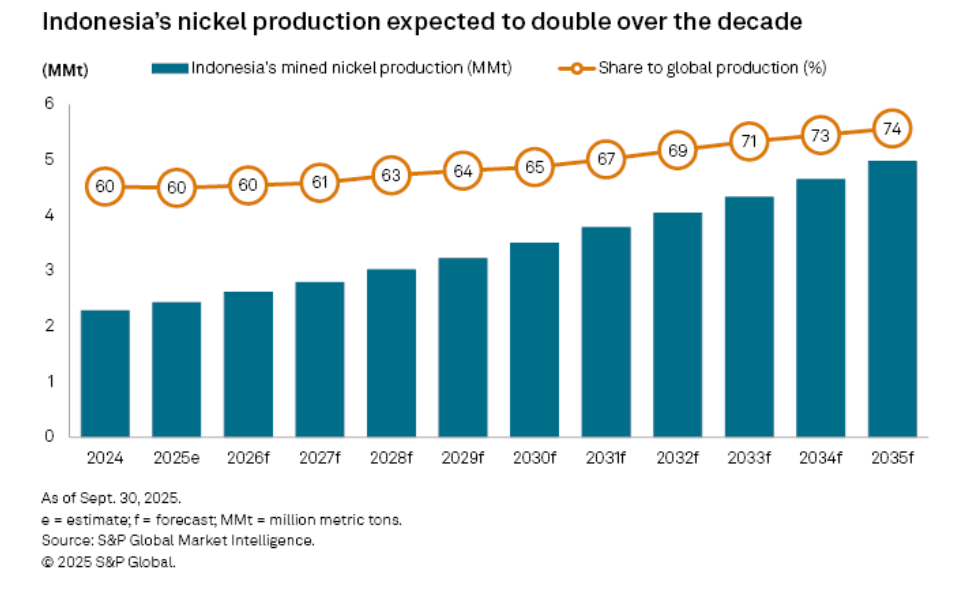

The trade deal provides a boost to Indonesia’s ambition to become a major electric vehicle supply chain hub, anchored by its thriving nickel industry. Indonesia dominated global nickel production in 2024 with 2.3 million metric tons, or about 59.7% of the world’s total output, according to S&P Global Market Intelligence data.

Indonesia’s rise in the nickel industry stemmed from a 2020 ore export ban that sparked downstream processing investments from foreign companies, mostly from China. However, this also resulted in an overflooded market that dragged down prices.

Platts assessed Indonesian nickel pig iron with 10% nickel content at $111.30 per metric ton FOB Indonesia on Nov. 14, down 13.0% from $128.00/t recorded Oct. 23, 2024 — the peak since the assessment was launched Feb. 19, 2024. Meanwhile, the London Metal Exchange nickel cash price closed at $14,782.11/t on Nov. 13, slumping 52.7% from a three-year high of $31,281.00/t on Dec. 7, 2022.

Several Indonesian nickel processing facilities use high pressure acid leaching (HPAL) technology, which is usually coal-fed and generates high volumes of waste. Some nickel companies are also accused of violating the human rights of workers. Amid these issues, global miners have called for a green premium on nickel to remain competitive against abundant Indonesian supply.

The European Commission said CEPA incorporates provisions of the EU’s Trade and Sustainable Development policies, a set of commitments to promote sustainable development between the bloc and its trade partners. But putting these terms into operation has always been challenging, analysts said.

“I think it’s very weak and there are really no sanctions or strong implications to the actors like multinational corporations or the state,” Rachmi said. “It only recognizes some standards and commitments.”

“The deal may also prove to be a double-edged sword, as it introduces rigid compliance requirements and standards that Indonesia must meet to align with global/EU market expectations,” Thomas Radityo, an equity research analyst at Indonesia-based Ciptadana Capital, told Platts.

China’s influence

Despite CEPA, the EU is unlikely to dominate Indonesia’s nickel industry as China’s influence will remain strong, said Linghui Ni, a nickel analyst at the London-based Project Blue research firm.

Ni said Indonesia and the EU depend on Chinese-dominated processing technologies such as HPAL to ensure the profitability of operations. China is a major consumer of stainless steel and nickel-based batteries, which are critical downstream products in the nickel supply chain. In contrast, the EU relies on scrap for its stainless steel needs, while its nickel demand for batteries is stable, Ni said.

“I believe the EU’s investments in Indonesia’s nickel sector are more likely to flow into existing operations and projects, many of which already involve Chinese companies,” Ni told Platts.

State responsibility

CEPA cannot solely elevate ESG standards in Indonesia’s nickel industry, highlighting the government’s crucial role in advancing sustainability, said Aryanto Nugroho, national coordinator of civil society group Publish What You Pay Indonesia.

“For ESG standards to improve, Indonesia needs policy space to enforce domestic regulations, invest in responsible processing, and ensure fair value distribution,” Aryanto told Platts.

Ahead of finalizing CEPA with the EU, Indonesia intensified efforts to clean up its nickel industry. The government seized 148 hectares at Eramet SA’s Weda Bay concession in September due to an alleged lack of forestry permits. In the same month, authorities suspended approximately 190 coal and mineral mining permits over alleged environmental breaches.

In June, authorities revoked the mining permits of four nickel companies in the protected Raja Ampat marine park. The government also outlined a National Nickel Industry Decarbonization Roadmap in the same month, with plans including an 81% emissions reduction target by 2045.

However, Indonesia may have reversed some of its ESG progress after allowing PT Gag Nikel to resume nickel operations near Raja Ampat, Thomas said.

After suspending Gag Nikel’s activities and conducting a review, the government determined that the company’s operations comply with environmental rules. Gag Nikel is a subsidiary of PT Aneka Tambang Tbk, commonly known as Antam, which is 65%-owned by state-run PT Mineral Industri Indonesia (Persero), based on Market Intelligence data.

“While exceptions under stricter oversight could be defensible, the move still casts doubt on its sustainability commitments and risks eroding trust with trade partners such as the EU,” Thomas said.

Neither the European Commission nor the Indonesian government responded to Platts’ requests for comment.

Writer: Karl Decena

Source: S&P Global